How to select insurance for a world trip?

Comparison of insurances

After listing all the criteria which was important for us and all the other factors, which can also help to decide (e.g. repatriation to the home country if needed, personal liability), we were compiling all the information from the websites and Policy wordings and prepared some charts to help us visualize all the data and support us in our final decision.

World Nomads was dropped already in the beginning, after seeing its prices. However, we may reconsider it in the future for a shorter period if time, to cover our stay in the USA. Besides, the Safety Wing was not added to the charts due to its deductible, which is 250 USD.

For easier comparison, we exchanged the amounts in pounds to euro.

Disclaimer: These data below are solely for visualisation and comparison for our case and made in the past months, therefore we are not taking any responsibility for the prices below. Before selecting insurance for yourself, please check the websites and choose the one which suits you the best, taking into account the most recent prices and coverage!

Price of the insurances

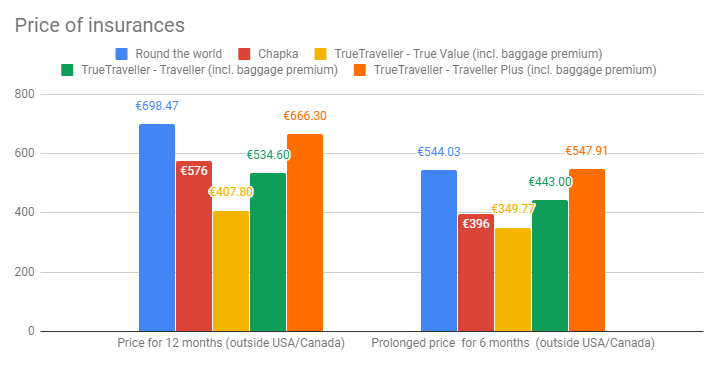

First and foremost, we compared the prices of the insurances. We were checking how much would it be for the first year if we are not including coverage for USA and Canada, and how much would it be if we extend the coverage for half year for North America as well. The prices for the first year are between 400-700 EUR, while for a half year North America it is between 350-550 EUR.

You may also consider covering the first 90 days with a different insurance (e.g. Gránit Bank in Hungary or the insurance of Revolut card), however, if we deduct 3 months coverage from the first year, the price doesn’t get significantly cheaper, so we are not going to take this opportunity.

Besides, we are going to take around 3-6 more months for South America as well. (This is going to be an extra 200-500 EUR.)

Medical coverage for North America and rest of the world

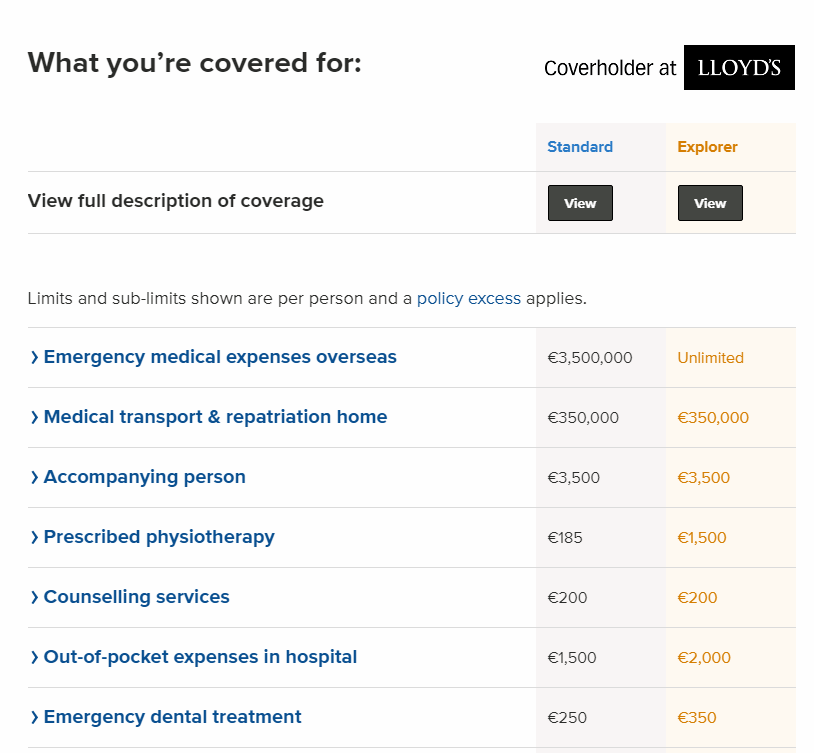

We checked the average medical cost in the countries where it is infamously expensive (see the picture at the criteria). This information almost automatically excluded the Chapka for us, we prefer to have higher insurance. World Nomads offers to kind of insurance, the more expensive one even covers unlimited coverage if you look for something like this.

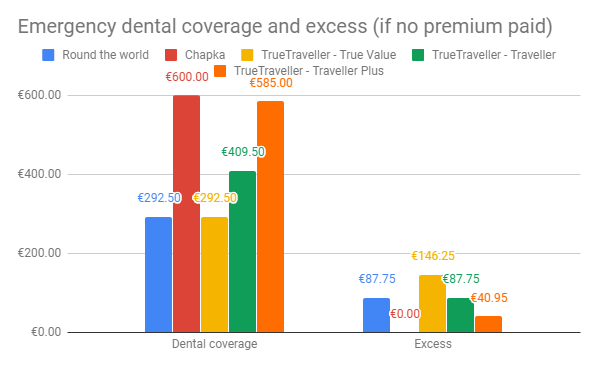

Emergency dental coverage and excess, if it needs to be paid

You can find examples to the dental prices here, they can be easily hundreds of euro. Excess payment can be nullified with the excess waiver at True traveller.

Medical coverage excess

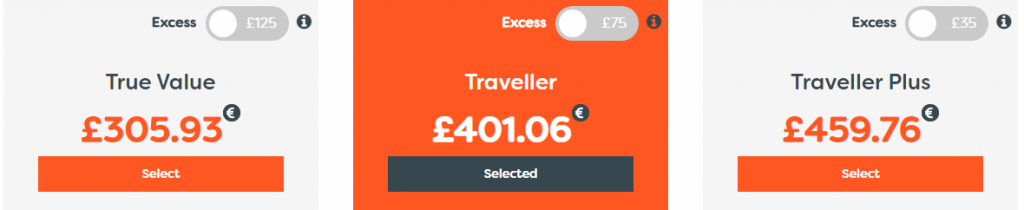

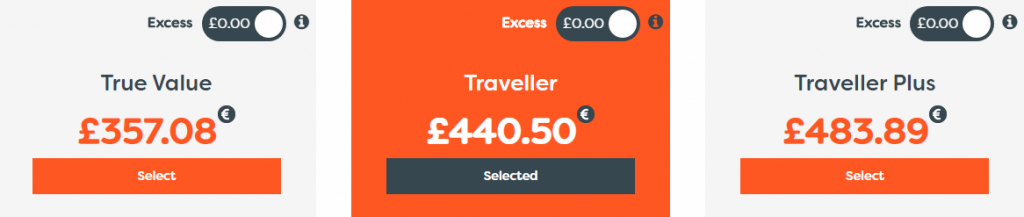

Yet again, True traveller has an excess waiver, below you can find an example for a 1-year-long insurance with and without excess.

Coverage of luggage and personal item

When we travelled with Transsiberian express, the luggage and gadget insurance we’ve spent the most, because we were bringing a DSLR and our stuff was quite exposed. We are going to sleep in hostels again, our backpack will travel with train and coaches, in which they are quite unprotected. (For instance, in Mongolia the driver didn’t open the trunk on the coach until everyone didn’t go close, to avoid the fast thieves around the bus.)

This time we also spent quite much on the luggage, since our backpack is going to be our home for these upcoming years, therefore we would like to cover its loss. Besides, since we are going to continue the blog on the road, we need to cover a laptop, phones, the gimbal, the action camera – and not every insurance is covering mobile phones, laptop or camera, as you can see below.

However, we’ve also heard a different point of view: maybe it is not worth to spend extra to cover our luggage better, since for that price we can also buy new stuffs (especially since not the original value is covered, but the items are depreciated), so take this into account as well.